Maximizing Savings: Tax Incentives for Green Building

In an era where sustainability has become increasingly critical, green building has emerged as an essential solution for mitigating environmental impact and promoting energy efficiency.

This article examines the concept of green building, its significance, and the various tax incentives available at the federal, state, and local levels designed to encourage this environmentally responsible practice.

These incentives not only contribute to a healthier planet but also provide financial benefits while enhancing property value.

The discussion will cover the requirements, advantages, and real-world examples of tax incentives associated with green building.

What Is Green Building?

Green building encompasses the practice of designing and constructing structures using environmentally responsible and resource-efficient processes throughout the entire lifecycle of a building.

This includes considerations from site selection to design, construction, operation, maintenance, renovation, and eventual demolition.

Such practices aim to minimize the overall environmental impact of buildings while promoting the adoption of sustainable construction methods that enhance energy efficiency and facilitate the use of renewable energy sources.

By incorporating eco-friendly materials and complying with stringent building codes, green building initiatives seek to significantly reduce carbon footprints and contribute to efforts aimed at mitigating climate change.

Why Is Green Building Important?

Green building is essential as it addresses significant environmental challenges, including climate change, resource depletion, and the necessity for sustainable urban development.

It underscores the importance of minimizing the carbon footprint of both residential and commercial structures, resulting in considerable environmental benefits.

By advocating for sustainability initiatives, green building practices not only improve the quality of life for occupants but also align with public policy objectives designed to promote community resilience and support habitat conservation efforts.

What Are the Tax Incentives for Green Building?

Tax incentives for green building play a crucial role in promoting the adoption of sustainable construction practices by offering financial benefits to property owners and developers.

These incentives may encompass government grants, tax credits, and various forms of financial assistance designed to encourage eco-friendly designs and energy-efficient renovations.

By utilizing these green financing options, stakeholders can make substantial investments in green architecture that comply with building regulations while concurrently enhancing property value and reducing construction costs.

1. Federal Tax Incentives

Federal tax incentives are strategically established to promote energy efficiency and the adoption of renewable energy sources in both residential and commercial buildings. These incentives typically manifest as investment tax credits, which offer substantial financial relief for property owners who invest in energy-efficient appliances, HVAC systems, and other sustainable technologies.

By facilitating access to these incentives, the federal government seeks to stimulate market demand for green building solutions and support climate action initiatives across the nation.

Among the prominent incentives available are:

- The Energy Efficient Home Credit, which provides builders with a tax credit for constructing homes that adhere to specific energy efficiency criteria.

- The Investment Tax Credit for solar energy systems, which allows property owners to offset a portion of their installation costs.

To qualify for these incentives, applicants generally must furnish documentation that demonstrates compliance with energy efficiency standards and complete the necessary forms to ensure proper processing. Consulting with a tax professional can be invaluable in navigating these requirements, maximizing benefits, and ultimately enhancing the feasibility of green building projects.

2. State Tax Incentives

State tax incentives for green building exhibit significant variability, offering financial benefits specifically designed to meet the needs of local governments and residents. These incentives may encompass property tax exemptions, green loans, and programs that promote energy audits to evaluate building performance.

By implementing such local incentives, states can effectively support sustainable practices and encourage community development that emphasizes environmental stewardship and resource efficiency.

Each state adopts its own strategy for promoting green building through tax incentives, with some jurisdictions providing substantial property tax exemptions for the use of sustainable construction materials or energy-efficient technologies.

For instance, states like California offer rebates for energy audits that assist in identifying areas for improvement in existing buildings, while other states may impose specific requirements based on the size and scope of the project.

Incentives may also differ based on whether a building complies with certain certification standards, thereby influencing the accessibility of these benefits for both developers and homeowners. A comprehensive understanding of these regional nuances is crucial for optimizing potential savings and contributing to the advancement of greener infrastructures.

3. Local Tax Incentives

Local tax incentives play a vital role in promoting green building practices within communities, often designed to align with specific zoning regulations and local requirements. These incentives may include reduced property taxes for developers who integrate sustainable design features into affordable housing projects or who engage in community initiatives centered on habitat conservation and urban development.

By utilizing local tax incentives, municipalities can stimulate the creation of green jobs and advance social equity within their development strategies.

Municipalities may also provide grants or rebates for energy-efficient renovations, specifically intended to enhance the accessibility of affordable housing. Such financial support not only aids developers in complying with stringent zoning standards but also fosters a collaborative environment in which community members can actively participate in sustainable practices.

Consequently, these incentives create a mutually beneficial situation: developers receive financial relief, while the broader community experiences improved living conditions and reduced utility expenses.

Ultimately, targeted local tax incentives are essential in harmonizing developmental objectives with ecological stewardship, ensuring that urban growth positively impacts both the environment and social well-being.

How Do Tax Incentives Encourage Green Building?

Tax incentives serve to promote green building initiatives by alleviating the financial challenges associated with sustainable construction practices. This makes it more feasible for developers and property owners to invest in eco-friendly materials and technologies.

By providing financial benefits such as tax credits and deductions, these incentives facilitate long-term savings on energy costs and enhance the overall economic viability of green building projects. Consequently, they align with broader sustainability initiatives aimed at mitigating the environmental impact of buildings.

Along with reducing initial construction costs, these incentives encourage a culture of innovation within the industry, motivating developers to explore advanced eco-friendly solutions. As a result, projects frequently incorporate renewable energy sources, such as solar panels, and sustainable construction methods that contribute to a reduced carbon footprint.

The appeal of lower operational expenses attracts buyers and tenants, thereby increasing demand for such properties. This shift not only strengthens the market for green buildings but also signifies a collective movement towards a more sustainable future, benefiting both communities and the planet.

What Are the Requirements for Receiving Tax Incentives?

To qualify for tax incentives, projects must adhere to specific requirements that align with established green building standards and sustainability certifications.

These requirements may encompass:

- Conducting energy audits

- Utilizing environmentally friendly materials

- Demonstrating compliance with local building codes and regulations

By strictly following these criteria, developers can ensure their projects are eligible for various financial assistance programs that promote sustainable construction.

1. Meeting Green Building Standards

Meeting green building standards is crucial for accessing tax incentives, as these standards delineate the necessary criteria for sustainable construction practices. Compliance with building regulations and environmental impact assessments ensures that projects fulfill requirements related to resource efficiency, energy performance, and overall environmental stewardship.

By adhering to these standards, developers not only enhance their eligibility for tax benefits but also make a positive contribution to the community and the environment.

Such adherence cultivates a culture of innovation within the construction industry, prompting the adoption of advanced technologies that optimize energy usage and minimize waste. This strategic approach positions developers favorably for financial incentives while also promoting long-term cost savings through enhanced operational efficiency.

By prioritizing sustainable practices, developers align themselves with broader global initiatives aimed at reducing carbon footprints, thereby reinforcing their commitment to responsible development. Ultimately, investing in green building standards is advantageous not only for compliance but also for fostering a healthier and more sustainable future for generations to come.

2. Obtaining Certifications

Obtaining certifications such as LEED certification is a vital step for projects aiming to qualify for tax incentives related to green building. These sustainability certifications serve as a formal acknowledgment of a building’s dedication to energy efficiency, environmentally responsible design, and sustainable practices.

By achieving such certifications, developers can enhance the marketability of their projects while fulfilling the necessary criteria to qualify for various tax incentives.

Pursuing sustainability certifications not only aligns with regulatory requirements but also reflects the increasing societal expectation for environmentally responsible building practices. Achieving credentials from recognized organizations such as the US Green Building Council or BREEAM demonstrates a strong commitment to minimizing environmental impact and promoting resource conservation.

This process typically involves comprehensive assessments of various elements, including material sourcing, water usage, and indoor air quality, to ensure that the project adheres to the rigorous standards established.

As businesses and consumers place greater emphasis on sustainability, projects that attain these certifications acquire a competitive advantage in a saturated market, positioning themselves as leaders in green architecture.

What Are the Benefits of Using Tax Incentives for Green Building?

Utilizing tax incentives for green building offers a multitude of benefits, not only for developers and property owners but also for communities and the environment as a whole.

These incentives result in substantial cost savings by lowering construction expenses and reducing long-term energy costs, while simultaneously contributing to a positive environmental impact through the promotion of sustainable practices and the reduction of greenhouse gas emissions.

Additionally, the adoption of green building principles supports community development and enhances the overall quality of life.

1. Cost Savings

One of the primary advantages of tax incentives for green building is the potential for substantial cost savings. By providing tax deductions and credits, these incentives can significantly lower initial construction expenses and offer ongoing energy savings for property owners.

This financial assistance allows developers to allocate more resources toward sustainable technologies and eco-friendly materials, ultimately enhancing the overall economic viability of their projects.

Such financial strategies not only improve profitability but also promote long-term operational efficiencies. For example, developers who integrate energy-efficient systems, such as solar panels or high-performance insulation, may qualify for federal and state tax deductions, which can further decrease their taxable income.

Property owners can experience considerable reductions in utility bills due to lower energy consumption, enabling them to recover their investments more rapidly.

These targeted incentives create a mutually beneficial scenario, encouraging the adoption of sustainable practices while simultaneously alleviating financial burdens.

2. Increased Property Value

Green building practices, bolstered by tax incentives, frequently result in enhanced property values owing to the rising market demand for sustainable and eco-friendly designs. Properties that comply with green building standards are often perceived as more desirable, attracting buyers and tenants who prioritize sustainability.

This increase in property value not only benefits developers but also contributes positively to the overall economic landscape of communities committed to sustainable growth.

As buyer preferences increasingly shift toward energy-efficient homes, market trends demonstrate a distinct advantage for properties that incorporate innovative green technologies and sustainable materials. Buyers are not only inclined to pay a premium for these eco-friendly designs, but they are also motivated by the potential for long-term savings on energy bills and maintenance costs.

With the growing awareness of climate change, many prospective homeowners actively seek properties that align with their values and commitment to environmental stewardship. Consequently, individuals investing in green building can expect a substantial return on investment, rendering sustainability not merely a moral imperative but also a prudent financial strategy in today’s competitive real estate market.

3. Positive Impact on the Environment

The implementation of tax incentives for green building exerts a significant positive impact on the environment by promoting practices that facilitate the reduction of carbon footprints and effective waste management. These incentives encourage the adoption of energy-efficient technologies, renewable energy sources, and eco-friendly materials, which collectively contribute to a decrease in greenhouse gas emissions and foster a more sustainable future. Consequently, communities experience improvements in air quality and enhanced ecosystem services.

These initiatives not only assist in minimizing construction waste but also promote social responsibility among builders and homeowners. By prioritizing sustainable design and construction practices, tax incentives give the power to individuals and businesses to make environmentally conscious decisions, thereby leading to resilient urban development.

This transition towards greener buildings ultimately mitigates resource depletion and encourages biodiversity, as developers frequently incorporate green spaces into their projects. Such measures not only protect natural habitats but also enhance the overall quality of life for residents, creating a mutually beneficial scenario for both the environment and society.

4. Improved Public Image

Engaging in green building practices and leveraging tax incentives can significantly enhance the public image of developers and companies, reflecting a strong commitment to corporate responsibility and sustainability initiatives. This favorable perception not only bolsters brand reputation but also aligns with the increasing consumer demand for environmentally conscious practices. Ultimately, this alignment can lead to the creation of green jobs and foster goodwill within the community.

By taking proactive measures toward sustainable development, organizations not only comply with regulatory expectations but often exceed them, demonstrating innovation in energy efficiency and resource management. Consequently, their efforts resonate positively with stakeholders who prioritize sustainability, thereby reinforcing trust and loyalty among customers.

Furthermore, these initiatives can serve as a catalyst for other businesses to adopt similar practices, generating a ripple effect that stimulates local economies through job creation in sectors such as renewable energy, energy efficiency retrofitting, and sustainable construction.

In conclusion, cultivating a culture of environmental stewardship positions organizations not only as industry leaders but also as responsible corporate citizens.

What Are Some Examples of Green Building Tax Incentives?

Numerous significant examples of green building tax incentives demonstrate how governments encourage sustainable construction practices.

Among these is the Energy-Efficient Commercial Buildings Deduction, which grants tax benefits to properties that achieve substantial reductions in energy consumption.

Additionally, Green Building Property Tax Exemptions provide financial relief to developers undertaking sustainable projects. These incentives act as a catalyst for the wider adoption of eco-friendly design and construction methodologies.

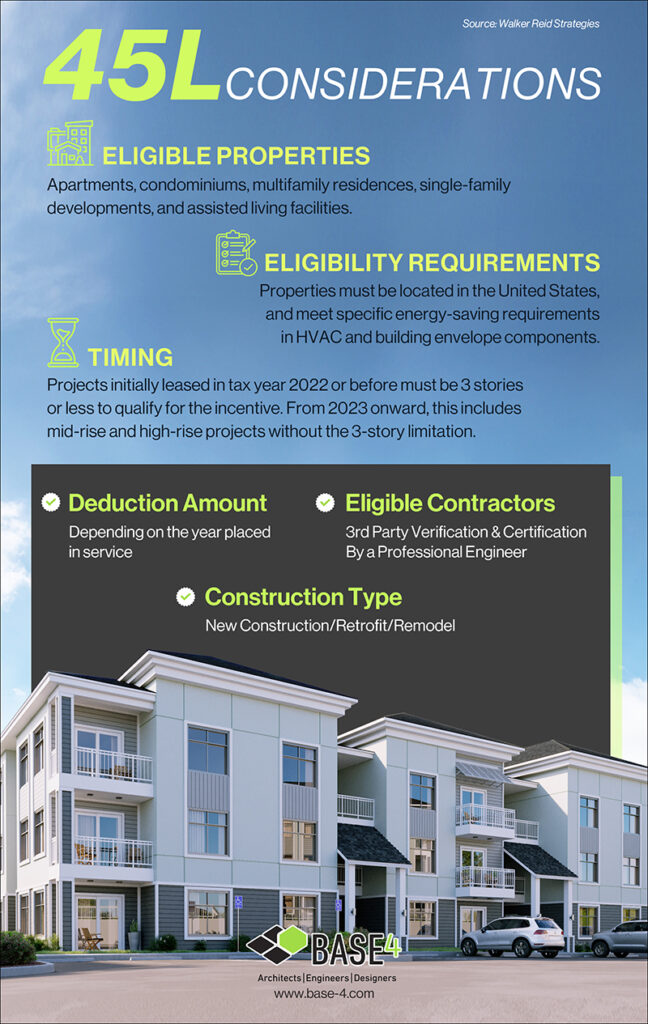

1. Energy-Efficient Commercial Buildings Deduction

The Energy-Efficient Commercial Buildings Deduction represents a significant tax incentive aimed at encouraging property owners to enhance the energy performance of their buildings. This deduction offers substantial tax savings for owners who invest in energy-efficient upgrades that comply with specific criteria, ultimately resulting in considerable energy savings over time.

To qualify for this deduction, property owners are required to implement improvements that reduce the overall energy and power costs of their buildings, in accordance with the standards established by the Internal Revenue Service (IRS).

Eligible upgrades may encompass enhancements to lighting, HVAC systems, and the building envelope, all of which are intended to foster a more sustainable and cost-effective environment.

By fulfilling these eligibility requirements, property owners not only gain immediate tax benefits but also realize long-term reductions in operating expenses. As buildings become increasingly energy-efficient, they frequently experience higher occupancy rates and increased market value, illustrating how the deduction can create a mutually beneficial scenario for both financial and environmental objectives.

2. Residential Energy Efficient Property Credit

The Residential Energy Efficient Property Credit is a tax credit designed to incentivize homeowners to invest in renewable energy systems, including solar panels and geothermal heat pumps. By offering financial incentives for these installations, this credit facilitates the transition toward energy-efficient residential buildings.

This tax credit permits eligible homeowners to deduct a substantial percentage of the costs associated with the purchase and installation of qualified renewable energy systems from their federal taxes. To qualify, homeowners must ensure that the systems are installed at their primary residence and adhere to specific performance and quality standards established by the Department of Energy.

Potential savings can vary significantly based on the installed systems and local incentives, often resulting in substantial tax savings amounting to thousands of dollars. This initiative not only provides advantages to individual homeowners but also contributes to broader environmental objectives by promoting sustainable energy solutions.

3. Green Building Property Tax Exemptions

Green Building Property Tax Exemptions are strategically designed to incentivize developers and property owners to adopt sustainable practices by providing substantial reductions in property taxes. These exemptions significantly enhance the financial viability of projects while simultaneously supporting the sustainability goals of local governments.

By alleviating the overall tax burden, these programs promote investment in energy-efficient technologies, renewable resources, and environmentally friendly materials. Consequently, this approach often leads to reduced operational costs for property owners, rendering green buildings not only environmentally sustainable but also economically advantageous in the long term.

Local governments stand to gain from this initiative as it aligns with their objectives of fostering a greener community, improving air quality, and decreasing energy consumption. As more developers incorporate sustainable practices into their projects, it cultivates a culture of responsibility, encouraging other stakeholders in the property market to adopt similar measures.

4. Green Building Sales Tax Exemptions

Green Building Sales Tax Exemptions offer significant financial relief by exempting specific eco-friendly materials and sustainable construction practices from sales tax. This policy incentivizes developers and contractors to select environmentally responsible options, thereby promoting a commitment to sustainability within the construction industry.

These exemptions generally encompass a broad range of materials, including energy-efficient windows, recycled insulation, and low-VOC paints, all of which play a vital role in reducing the carbon footprint of buildings.

By decreasing upfront costs, these tax incentives encourage the adoption of innovative building technologies and greener practices that ultimately result in long-term savings on energy expenses and maintenance.

Utilizing eco-friendly materials not only enhances the performance of a building but also improves indoor air quality, thereby creating healthier environments for occupants. As an increasing number of builders capitalize on these incentives, the movement toward sustainable development gains momentum, yielding positive outcomes for both the environment and the economy.

Frequently Asked Questions

What are tax incentives for green building?

Tax incentives for green building are financial benefits provided by governments to encourage the construction of environmentally-friendly buildings. These incentives can include tax credits, deductions, exemptions, or other tax breaks.

What types of green building projects are eligible for tax incentives?

The eligibility for tax incentives varies by country and region, but generally, any building project that incorporates energy efficiency, renewable energy, water conservation, or other sustainable features may qualify for tax incentives.

Do tax incentives for green building apply to residential and commercial buildings?

Yes, tax incentives for green building can apply to both residential and commercial buildings. In some cases, there may be different incentives available for each type of building.

How can I find out if my green building project is eligible for tax incentives?

You can check with your local government’s tax department or environmental agency to see what tax incentives are available for green building projects in your area. You may also want to consult with a tax professional or green building expert for more information.

Can tax incentives for green building help save me money?

Yes, tax incentives for green building can help save you money by reducing your tax liability. They can also help offset the higher upfront costs of building green, making it a more financially feasible option.

Are there any other benefits to building green besides tax incentives?

Yes, there are many benefits to building green, including reduced operating costs, improved indoor air quality, and a smaller carbon footprint. Building green can also increase the value and marketability of a property.

I’m Bruno, an architect with a deep passion for Biophilic Design in Urban Architecture. Throughout my career, I’ve focused on integrating natural elements into urban planning, and I created this site to share my insights and foster a deeper understanding of how biophilic principles can significantly enhance urban living. Dedicated to sustainable development, I continually explore innovative design solutions that promote both environmental and human well-being in city landscapes.

Publicar comentário